The U.S.–China Trade Deficit: The Numbers Lie (A Bit)

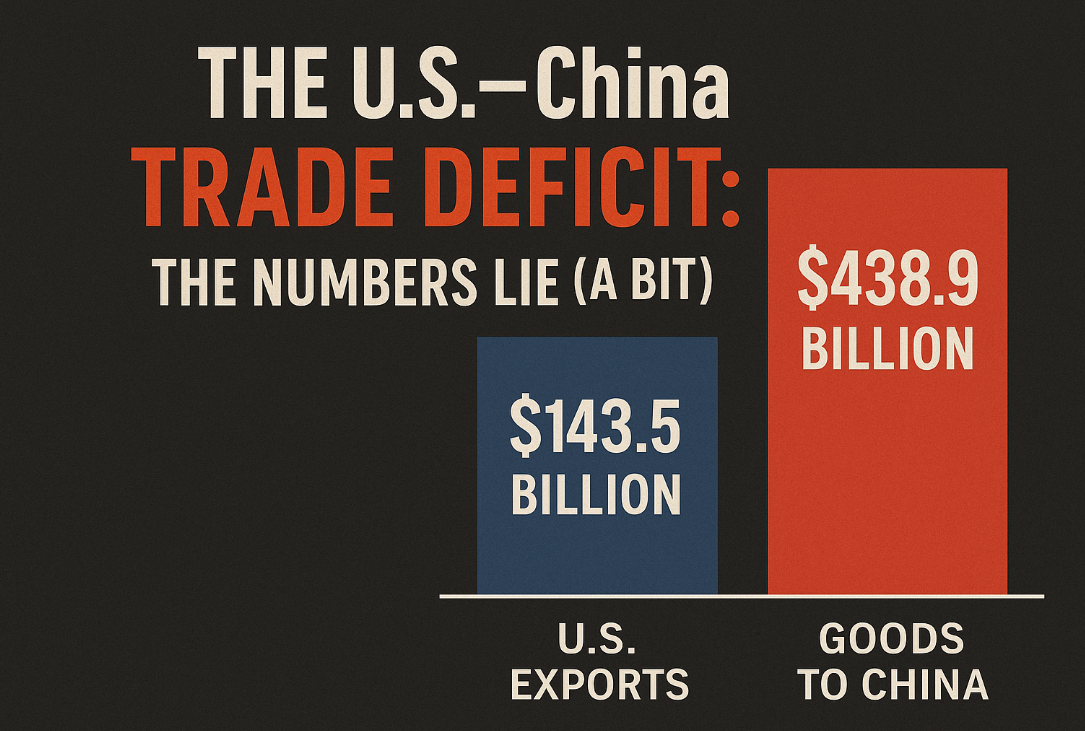

When headlines scream about the $295 billion trade deficit the United States had with China in 2024, it paints a picture of lopsided economic failure. The U.S. shipped $143.5 billion in goods to China, while $438.9 billion worth flowed in the other direction. But here’s the catch: gross trade volumes are not the full story. If we zoom in on value creation and profit margins, the balance of power becomes a lot murkier—and far more interesting.

Not All Exports Are Created Equal

Let’s talk iPhones. Manufactured in China, exported globally, and counted as a Chinese export to the U.S.—yet the vast majority of profits and value go to Apple (a U.S. company), semiconductor giants in Taiwan and the U.S., display makers in Korea and Japan, and a web of high-tech suppliers around the world. China’s role? Assembly and logistics. The margin? Around 5–10%, if that.

This is the case for a massive chunk of China’s exports, especially in:

- Electronics ($896 billion in 2023 exports)

- Machinery and Equipment

- Automobiles and EVs (an emerging sector)

China is a factory—but not always the inventor, designer, or IP owner.

China’s Profit Problem

Even as the “world’s factory,” China’s value-added content in many exports is relatively low:

- For high-tech electronics, domestic value-added may be under 20%.

- For automotive, it’s improving, but still reliant on imported components.

- For pharmaceuticals and semiconductors, China is critically dependent on imports and foreign technology.

In other words: China exports a lot, but keeps a small slice of the pie.

The U.S. Plays the Long Game

Even though the U.S. exports less in raw goods, it dominates high-margin, high-IP sectors, including:

- Pharmaceuticals

- Aerospace

- Semiconductors

- Advanced machinery

And critically, the U.S. exports a massive amount of services:

- $295 billion surplus in services trade in 2024

- Licensing of software, patents, and trademarks

- Financial and cloud services consumed globally

These exports often don’t show up in traditional trade deficit headlines—but they fuel U.S. tech giants, Wall Street, and innovation hubs across the country.

Value-Added: The True Trade Battleground

Here’s what really matters:

| Sector | China’s Role | U.S. Role | Margin Split |

|---|---|---|---|

| iPhones | Assembly | Design, IP, Marketing | U.S. wins |

| Electric Vehicles | Manufacturing (growing) | R&D, Chips, Brand | Shared |

| Pharmaceuticals | API production | Discovery, Trials, Brand | U.S. wins |

| Software & Cloud | Emerging player | Global dominance | U.S. wins |

In most high-tech or service-driven industries, the U.S. captures the profit even if China handles the production.

So Who’s Winning?

That depends on what “winning” means. China dominates global supply chains and employs millions in export industries. But its dependency on foreign tech and low value-added margins are strategic weaknesses. Meanwhile, the U.S., despite its trade deficit, sits on top of the pyramid in IP, branding, and services.

The global trade war isn’t just about tariffs or deficits—it’s about who controls the high ground of value creation.

And in that game, the U.S. isn’t losing. It may even be quietly winning.